Perpetual futures explained for 2026 with clear examples, risks, funding fees, and smart tactics to trade nonstop contracts with more control.

Perpetual futures are everywhere in modern trading. They never expire, trade around the clock, and offer easy leverage. However, many traders jump in without fully understanding how these contracts really behave. That gap often leads to unexpected losses.

At its core, perpetual futures let you speculate on price movements without owning the asset. You can go long or short, adjust leverage, and keep positions open indefinitely. Still, the mechanics behind the scenes matter more than most people realize.

For example, a trader might hold a winning position for days, only to see profits slowly shrink because of funding fees. Understanding those details changes how you trade.

What Perpetual Futures Really Are

Perpetual futures are derivative contracts designed to track the price of an underlying asset, such as Bitcoin, Ethereum, or an index. Unlike traditional futures, they do not have an expiration date.

Instead of expiring, they rely on a funding mechanism to keep prices aligned with the spot market. That mechanism quietly shapes profits and losses over time.

If you are new to derivatives, reading a derivatives trading overview can help you understand how these contracts fit into the bigger picture.

How Funding Rates Actually Work

Funding rates are periodic payments exchanged between long and short traders. They exist to push the perpetual futures price back toward the spot price.

When the market is bullish:

- longs usually pay shorts

When the market is bearish:

- shorts usually pay longs

These payments happen every few hours on most platforms.

Real-life micro-scenario:

A trader holds a long BTC perpetual during a strong rally. The price barely moves for a day, yet their balance slowly decreases. The reason is funding payments stacking up while the market stays overheated.

This is why perpetual futures reward timing, not patience.

Leverage Makes Everything Faster

Perpetual futures allow leverage, which amplifies both gains and losses. Even a small move can have a big impact on your account.

That’s why liquidation risk is always present. If price moves against you far enough, the exchange will close your position automatically.

Many traders manage this risk by choosing the right margin mode. Understanding cross vs isolated margin can prevent one bad trade from damaging your entire account.

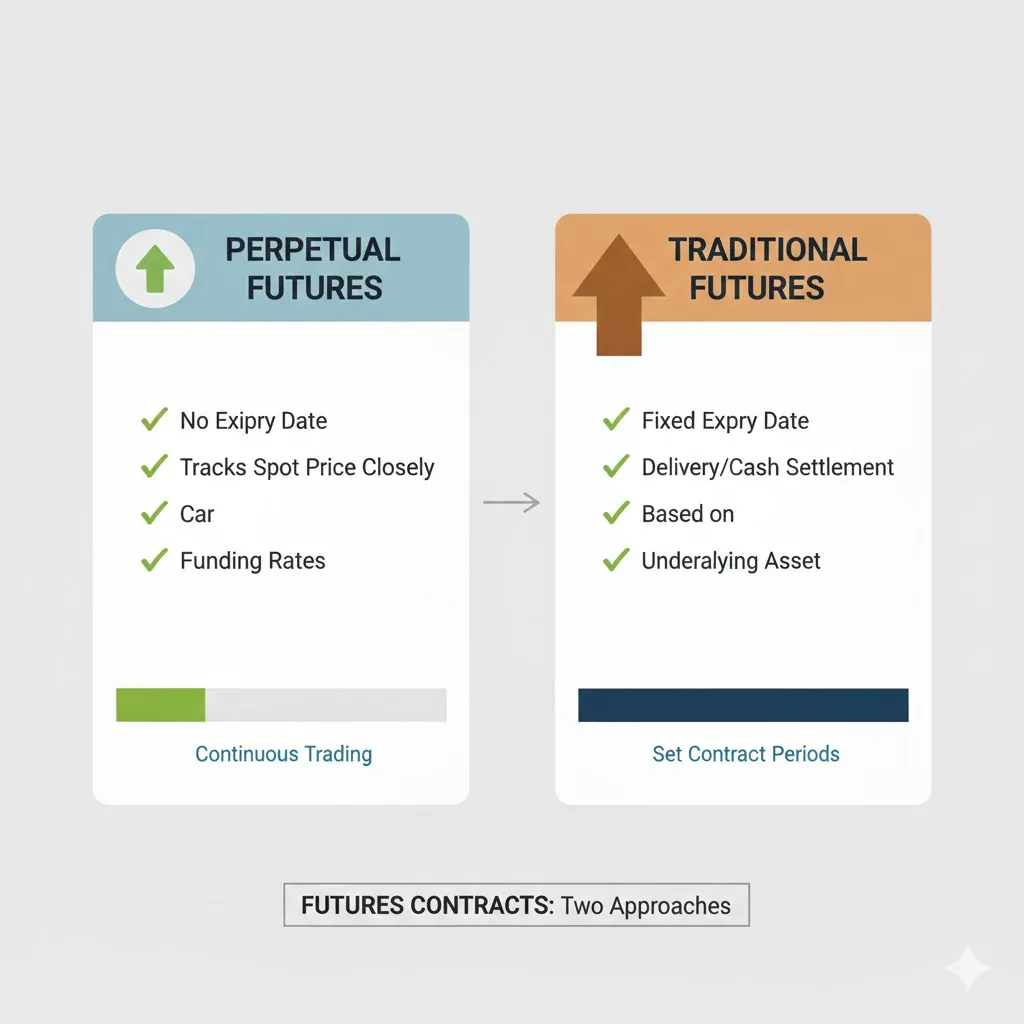

Perpetual Futures vs Traditional Futures

| Feature | Perpetual Futures | Traditional Futures |

|---|---|---|

| Expiration date | None | Yes |

| Funding payments | Yes | No |

| Popular markets | Crypto, indexes | Commodities, indexes |

| Holding duration | Flexible | Fixed term |

| Beginner accessibility | Easier | More complex |

This comparison explains why perpetual futures dominate crypto trading, while traditional futures remain common in regulated markets.

When Perpetual Futures Make Sense

Perpetual futures can be useful when used with intention.

They often fit traders who:

- want to short markets easily

- trade short- to medium-term trends

- need flexible entry and exit timing

- manage risk with tight position sizing

For example, a trader might use perpetual futures to hedge a spot position during high volatility, then close quickly once conditions stabilize.

Still, they are not ideal for passive strategies. If you want long-term exposure, spot markets are often calmer.

Pro Insight

Many experienced traders avoid holding perpetual futures during high funding periods. They wait for funding to normalize before entering, even if the chart looks perfect.

Common Mistakes With Perpetual Futures

Ignoring funding costs

Small payments add up over time, especially with leverage.

Using too much leverage

High leverage reduces margin for error and increases emotional pressure.

Holding losing trades too long

Because there is no expiration, traders often delay exits instead of accepting small losses.

Trading without a clear plan

Without defined exits, perpetual futures turn fast markets into emotional traps.

A simple risk management checklist can help you avoid repeating these mistakes.

Quick Tip

If funding rates are high, consider reducing position size or closing before the funding window. Preserving capital often matters more than catching every move.

FAQs About Perpetual Futures

Are perpetual futures the same as margin trading?

Not exactly. Perpetual futures are contracts, while margin trading usually involves borrowing to trade spot assets.

Can you hold perpetual futures forever?

Yes, technically. However, funding fees and volatility make long holding periods risky.

Why do perpetual futures prices differ from spot prices?

Short-term imbalances between buyers and sellers can cause gaps, which funding rates aim to correct.

Are perpetual futures only for crypto?

They are most common in crypto, but similar products exist in other markets.

Are perpetual futures suitable for beginners?

They can be, but beginners should start with low leverage and small position sizes.

Disclaimer

Trading involves risk and may result in losses. This content is for general informational purposes only and does not provide financial or investment advice. Always assess your own risk tolerance.