Understand funding rates in 2026 with clear examples, hidden costs, and smart tactics to trade perpetual contracts without leaking profits.

Funding rates are easy to overlook because they don’t look dramatic on a chart. However, they quietly decide whether a profitable trade stays profitable. If you trade perpetual futures, funding rates are not optional knowledge—they’re part of your P&L.

For example, a trader can be right on direction and still lose money simply by holding a position during expensive funding windows. Once you see how funding works, you’ll time entries and exits very differently.

What Funding Rates Really Are

Funding rates are periodic payments exchanged between long and short traders on perpetual futures markets. They exist to keep the perpetual price close to the spot price.

When the market is crowded on one side, funding nudges traders to rebalance:

- If most traders are long, longs pay shorts

- If most traders are short, shorts pay longs

These payments usually happen every few hours, depending on the exchange.

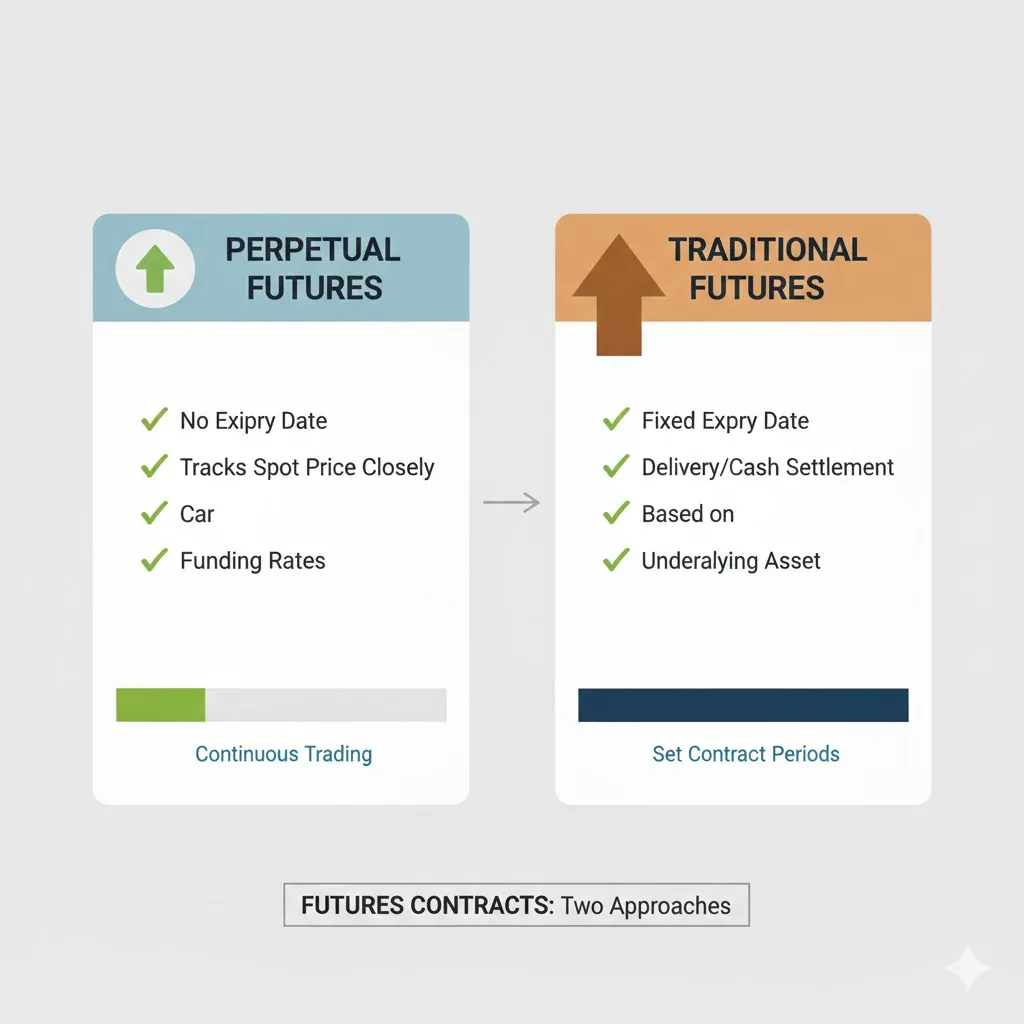

If you’re new to these contracts, it helps to review a perpetual futures overview and a derivatives trading guide to see where funding fits in.

How Funding Rates Are Calculated

While formulas vary by exchange, funding rates generally reflect:

- the gap between perpetual and spot prices

- market demand imbalance

- interest rate components

The result is a percentage applied to your position size, not your margin. Therefore, larger positions feel funding more sharply.

Real-life micro-scenario:

A trader holds a $50,000 long position with a 0.03% funding rate. Every funding interval, they pay $15. Over a day, that adds up—especially if price stalls.

Why Funding Rates Matter More Than Fees

Trading fees are paid once. Funding rates repeat.

This is why funding often matters more than entry fees for traders who hold positions longer than a few hours.

| Cost Type | When You Pay | Impact Over Time |

|---|---|---|

| Trading fees | Entry and exit | Fixed |

| Funding rates | Repeating intervals | Compounding |

| Slippage | During execution | Situational |

| Liquidation fees | Only if liquidated | Severe |

This comparison shows why ignoring funding is like ignoring rent while focusing on grocery prices.

Bull Markets vs Bear Markets Funding Behavior

Funding rates change with sentiment.

During strong bullish phases

Funding often turns positive. Longs pay shorts because many traders expect prices to rise.

During fear-driven drops

Funding can flip negative. Shorts pay longs as traders pile into downside bets.

Still, extreme funding on either side is a warning sign. Crowded trades tend to unwind fast.

Many traders track funding alongside price and open interest. Pairing this with a risk management checklist helps avoid emotional entries.

Pro Insight

Experienced traders don’t chase momentum when funding spikes. They often wait for funding to cool down, even if that means missing the first part of a move.

How Funding Rates Affect Strategy

Funding rates should influence how long you hold a trade.

They work best for:

- short-term momentum trades

- intraday setups

- quick hedges

They work poorly for:

- long, slow holds

- sideways markets with high funding

- overleveraged positions

For example, many traders close positions just before funding timestamps and re-enter later to reduce cost exposure.

Quick Tip

Always check the next funding time before entering a trade. If funding is high and price is flat, waiting can be the smarter move.

Common Funding Rate Mistakes

Holding winners too long

A good trade can slowly bleed if funding stays expensive.

Using high leverage during high funding

Leverage magnifies funding costs, not just price moves.

Ignoring negative funding opportunities

Negative funding can actually pay you, but only if risk is controlled.

Treating funding as background noise

Funding is part of strategy, not a footnote.

If you also trade leverage, understanding cross vs isolated margin helps limit damage when funding and volatility combine.

FAQs About Funding Rates

Do funding rates apply to spot trading?

No. Funding rates only apply to perpetual futures and similar derivative contracts.

Can funding rates change suddenly?

Yes. They adjust based on market conditions and can shift quickly during volatility.

Is negative funding always good?

Not necessarily. You may earn funding, but price risk still matters more.

How often are funding rates charged?

Most exchanges charge every 8 hours, though timing varies.

Do funding rates guarantee price reversals?

No. They signal crowding, not certainty.

Disclaimer

Trading involves risk and may result in losses. This content is for informational purposes only and does not provide financial or investment advice. Always assess your own risk tolerance.