Cryptocurrency has moved from niche tech circles into mainstream U.S. finance. But for many Americans, the question remains: What is cryptocurrency—and why does it matter? In 2025, understanding digital money isn’t optional anymore. It affects investing, banking, online payments, and even global commerce.

For informational purposes only — not financial advice.

Think of cryptocurrency as the next evolution of money: borderless, programmable, transparent, and powered by decentralized networks instead of banks. And once you understand the foundations, the entire crypto world becomes much easier to navigate.

What Is Cryptocurrency?

Cryptocurrency is digital money secured by cryptography and stored on a decentralized network called a blockchain. Unlike dollars in a bank, crypto doesn’t rely on a government or financial institution to operate. Instead, a global network of computers validates and records transactions.

Key traits:

- Fully digital

- Runs on blockchain

- Not controlled by any single authority

- Can be sent globally in seconds

- Transparent and publicly verifiable

Popular forms of cryptocurrency:

- Bitcoin (BTC): created as digital gold

- Ethereum (ETH): runs decentralized applications

- Stablecoins: crypto tied to the U.S. dollar

- Altcoins: thousands of alternative digital assets

Crypto is used for investing, payments, saving, borrowing, trading, gaming, and more.

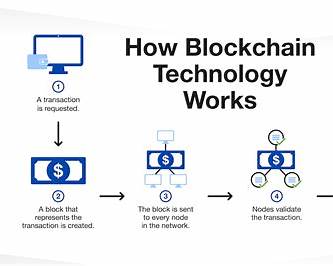

How Cryptocurrency Works (Beginner-Friendly)

Here’s the simplest explanation:

Crypto is digital money stored on a shared global ledger.

That ledger is called blockchain—a system where every transaction is recorded and cannot be changed.

How it works:

- You send crypto to someone.

- The transaction is verified by a network of computers.

- Once verified, it becomes part of the blockchain forever.

No bank.

No middleman.

Just trust built into the technology itself.

Why Cryptocurrency Exists

Cryptocurrency was created to solve several problems:

1. Slow and expensive banking

Crypto transfers are fast—even international ones.

2. Lack of financial access

Millions of people globally cannot access traditional banks.

3. Centralized control

Crypto offers a decentralized alternative.

4. Inflation concerns

Some cryptocurrencies (like Bitcoin) have limited supply.

5. Programmable money

Ethereum allows smart contracts—self-executing programs that run financial actions automatically.

Types of Cryptocurrency

1. Bitcoin (BTC)

The first and most established cryptocurrency.

2. Ethereum (ETH)

A programmable blockchain for apps, tokens, and smart contracts.

3. Stablecoins (USDC, USDT)

Value stays at $1—popular for payments and savings.

4. Altcoins

Thousands of alternative crypto assets with unique use cases.

5. DeFi Tokens

Used in decentralized finance apps like lending, staking, and trading.

Benefits of Cryptocurrency

1. Fast Transactions

Send money anywhere in seconds.

2. Lower Fees

Especially for international payments.

3. Ownership & Control

You control your funds—not a bank.

4. Transparency

Every transaction is publicly recorded.

5. Investment Opportunities

Bitcoin and Ethereum are now widely considered long-term digital assets.

Risks of Cryptocurrency (You Must Know)

Crypto is powerful—but not risk-free.

1. Volatility

Prices can move dramatically in short periods.

2. Cybersecurity

Hacks, scams, and phishing attempts are real threats.

3. Regulation

U.S. rules continue evolving in 2025.

4. Technical Complexity

Beginners must learn wallets, keys, and networks.

5. Irreversible Transactions

Mistakes cannot be undone.

Quick Tip:

Always start with small investments and use trusted U.S.-regulated exchanges.

How to Get Started With Cryptocurrency

1. Choose a regulated U.S. exchange

Examples:

- Coinbase

- Kraken

- Gemini

2. Buy core assets first

- Bitcoin

- Ethereum

3. Use a secure wallet

Hardware wallets = best long-term safety.

4. Learn before investing

Avoid hype-driven projects and meme coins early on.

5. Manage risk

Crypto should be part of your portfolio—not your entire savings.

Pro Insight: Crypto Is a Tool, Not a Shortcut

Professionals treat crypto like any other investment:

- Diversify

- Protect your keys

- Take profits

- Avoid emotional decisions

Crypto’s long-term winners are the people who stay consistent—not those who chase fast gains.

Comparison Table: Crypto vs Traditional Money

| Feature | Cryptocurrency | U.S. Dollar |

|---|---|---|

| Control | Decentralized | Government-controlled |

| Speed | Seconds, global | Hours–days (banks) |

| Supply | Limited (BTC) | Unlimited |

| Transparency | Public ledger | Private system |

| Reversibility | None | Possible via banks |

| Best For | Digital payments, investing | Everyday transactions |

Frequently Asked Questions

What is cryptocurrency in simple terms?

Cryptocurrency is digital money that uses blockchain technology to record and verify transactions without banks.

Is crypto safe?

Crypto is safe when stored properly using secure wallets and strong cybersecurity habits, but it carries price volatility and regulatory risks.

How do beginners start investing in crypto?

Open an account with a regulated U.S. exchange, buy Bitcoin or Ethereum, and store long-term assets in a hardware wallet.

Can crypto replace traditional money?

Not entirely, but it already complements traditional finance and powers new systems like decentralized finance (DeFi).

Do I need a lot of money to start?

No. Many platforms let beginners start with as little as $10.

External Authority Sources

https://www.consumerfinance.gov

https://www.usa.gov

https://www.census.gov