Crypto moves fast—but crypto liquidity determines how smoothly it moves. In 2025, with U.S. regulations tightening and new blockchain networks scaling rapidly, liquidity has become one of the most important metrics for judging the strength, safety, and real usability of a digital asset.

For informational purposes only — not financial or legal advice.

If market cap tells you the size of a crypto asset, liquidity tells you how alive it is. High liquidity means you can buy or sell quickly without moving the price. Low liquidity means danger: price slippage, manipulation, and difficulty exiting a position.

What Is Crypto Liquidity?

Crypto liquidity refers to how easily an asset can be bought or sold without significantly affecting its price.

High liquidity =

✔ Tight bid–ask spreads

✔ Faster trade execution

✔ Lower fees/slippage

✔ More stable prices

✔ Safer for large transactions

Low liquidity =

✘ Big price swings

✘ Difficulty selling

✘ High slippage

✘ Increased manipulation risk

Liquidity is the backbone of healthy markets.

Why Liquidity Matters for U.S. Crypto Investors

1. Lower Slippage

You get the price you expect when buying or selling.

2. Faster Transactions

Orders fill instantly in liquid markets.

3. Lower Manipulation Risk

Illiquid assets are easier to pump-and-dump.

4. More Reliable Price Action

Technical analysis only works well with strong liquidity.

5. Easier Entry and Exit

Perfect for both long-term investors and active traders.

Liquidity is one of the strongest indicators of a crypto asset’s real demand.

Where Liquidity Comes From

1. Exchanges

Centralized exchanges (Coinbase, Kraken) supply liquidity through:

- Market makers

- High trading volume

- Deep order books

2. Decentralized Exchanges (DEXs)

DEXs like Uniswap and Curve use liquidity pools, where users deposit assets to enable trades.

3. Market Makers

Specialized trading firms that keep markets efficient.

4. Institutional Participants

2025 sees more hedge funds and financial firms providing liquidity—especially in BTC, ETH, and major stablecoins.

How to Check Crypto Liquidity (Beginner-Friendly)

1. 24h Trading Volume

Higher = better.

BTC and ETH often exceed $10B+ daily, showing massive liquidity.

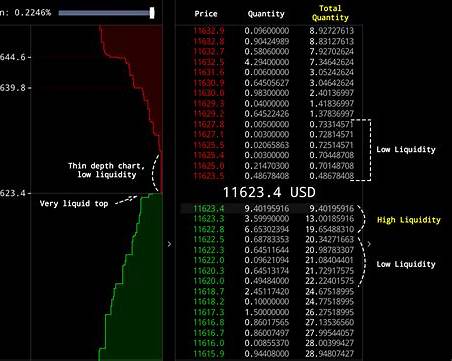

2. Order Book Depth

Deeper books mean more buy/sell support.

3. Slippage Estimates

Exchanges show how much the price will move for a trade.

4. Liquidity Pool Size (DEX)

Bigger pools = smoother trades with lower price impact.

5. Exchange Listings

More listings = more liquidity sources.

High-Liquidity vs Low-Liquidity Assets

High-Liquidity Assets

- Bitcoin

- Ethereum

- Major stablecoins (USDC, USDT)

- Top 20 market cap cryptos

Pros:

- Safer for beginners

- Lower slippage

- Predictable pricing

Low-Liquidity Assets

- Small-cap altcoins

- Meme coins

- New tokens

- Illiquid DeFi assets

Risks:

- Extreme volatility

- Hard to sell during market drops

- Easy to manipulate

Quick Tip:

If a coin falls 30% the moment you try to sell it, it’s not an investment—it’s a trap.

Liquidity in DeFi (2025 Evolution)

DEX liquidity is now more sophisticated than ever.

Key Innovations

- Concentrated liquidity (Uniswap v3+)

- Cross-chain liquidity routing

- Institutional liquidity providers

- Tokenized real-world asset pools (Treasuries, bonds)

Liquidity Pools Offer:

- Trading depth

- Rewards for liquidity providers

- Automated market making (AMM)

But they also carry risks:

- Impermanent loss

- Smart contract exploits

- Low-volume pool volatility

Pro Insight: Liquidity Dries Up FAST During Crashes

In market panics:

- Altcoin liquidity disappears

- Spreads widen

- Gas fees rise

- Traders rush to stablecoins

- Order books thin instantly

This is why professional investors prefer:

- High-liquidity assets

- Clear exit strategies

- Heavy stablecoin buffers

Your trade doesn’t matter until you can exit it.

Comparison Table: Crypto Liquidity Metrics

| Metric | What It Shows | Risk Level | Notes |

|---|---|---|---|

| 24h Volume | Activity & demand | Low | Most reliable |

| Order Book Depth | Buy/sell support | Low | CEX-focused |

| Liquidity Pool Size | DEX trading stability | Medium | Pool volatility matters |

| Slippage | Execution quality | Medium | Higher in small caps |

| Exchange Availability | User access | Low | More listings = safer |

Frequently Asked Questions

What is liquidity in crypto?

Liquidity measures how easily a crypto asset can be bought or sold without major price changes.

Why is liquidity important?

It reduces slippage, price volatility, and manipulation—making trading safer and smoother.

How do beginners check liquidity?

Look at trading volume, exchange listings, slippage estimates, and liquidity pool size for DEX trades.

Is low liquidity bad?

Not always—but it increases risk dramatically and makes entering or exiting positions harder.

Which cryptos have the best liquidity?

Bitcoin, Ethereum, and major stablecoins consistently lead global liquidity.

External Authority Sources

https://www.consumerfinance.gov

https://www.usa.gov

https://www.census.gov